Some interesting divergences with the SPX and the commercial positions on oil and copper in the most recent Commitment Of Traders report. Leaving my bias out, looking purely at the charts, the SPX appears ready to finally correct. So without any further commentary, here's what we have. For those new to the COT report there are three categories of traders (1) Commercial - don't fade these people, (2) Non Commercial (3) Non Reporting - fade these people.

SPX versus Copper Commercial Net

SPX versus Copper Commercial Net

SPX versus Crude Commercial Net - the only "color" I will add here is notice how about six weeks ago the SPX popped above the position line when the prior sixty weeks it was below, all while the rate of change of the CL position has slowed.

SPX versus Nymex Light Sweet Crude - This chart is as of 1/25 (Tuesday) before oil prices spiked with the protests in Egypt. So if I were to draw the chart as of Friday 1/28 the divergence would be far less but "this time it's different." This time the spike in oil is purely on fear and we know how fear is supposed to affect risk assets.

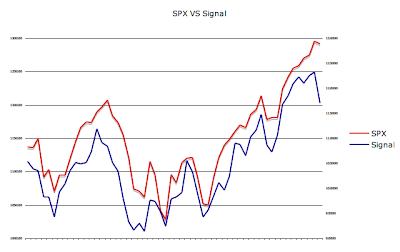

I have a proprietary trade signal which has correlated nicely with the SPX and also showing divergence.

No comments:

Post a Comment