Below are two charts. One is a three year daily showing the trend line that has served as support each time it's been tested.

It was a cold November morning as I took my first step into the dark canyon. The challenge of running to the north rim and back awaited; but this journey was greater than the 50 miles before me. This was about discovering the greatness that lies within us. We all have dreams, desires to achieve what others say cannot be done. With passion, hard work and the willingness to suffer, our success awaits.

"Life is either a daring adventure or nothing" - Helen Keller

Monday, January 31, 2011

USD - Does Anyone Want It

Below are two charts. One is a three year daily showing the trend line that has served as support each time it's been tested.

Q4 GDP - A Look Inside

Like anything though you need to read behind the headline to find the true story. Without making GDP to confusing, let's break it down to the simple formula

GDP = Consumer (C) + Investment (I) + Government (G) + Trade Balance (T)

The chart below shows how each component of GDP have changed over the past eight quarters. The two areas that standout are the changes in (I) investment and (T) trade. We did notice (G) government begin to turn down and become a net drag on GDP and we also saw (C) consumer tick up adding more to GDP growth. For the most part though (I) & (T) were the largest fluctuations.

The Trade component was a little confusing as it showed an increase in exports which makes sense considering the dollar debasement, but a substantial decrease in import growth by 2.40%. The drawdown in inventories would be offset partially by the drawdown in imports but the amount was larger than would be expected considering the fact that the consumer showed strength this holiday. GDP is quoted in real terms (inflation adjusted) from nominal values. The BEA uses different price deflators in this adjustment and the deflator for imports is much larger than that of GDP as a whole (.3% for GDP and 21.8% for imports). So part of this trade benefit to GDP was purely using an uneven price deflator that favored GDP versus imports.

The Investment component which is where inventory resides, showed the first drawdown in inventory levels in five quarters. Odds are this is not a blip but rather a trend where inventory will continue to be a drag on GDP. Until real demand comes back into the economy the desire to build GDP to higher levels will not be there. So as inventory levels stagnate or reduce further based on sales, the (I) investment component of GDP should put more downward pressure on GDP.

Q4 GDP - A Look Inside

Ah - Risk Assets

Bulls that are long anything are rewarded each day and grow smarter and smarter each day. Little hint of sarcasm there with the smarter comment. Anyone who has blown up an account, which is pretty much any successful trader understands the worst thing that can happen is finding success in the market when you really don't know what you are doing. The smarter you think you are the more you are being ready for an expensive lesson on trading capital markets.

I noticed a comment the past few days from a "retail" site I pop in on at times of how their prior level of leverage was not enough. They are literally finding any money they can and moving it into equities and leveraging up. You can't get anymore bullish than that from a retail standpoint.

Silver managed to catch a bid today while gold did not but did recoup some of its losses. Tomorrow is the million person march in Cairo so that could be interesting. Banks are shut down and food is tight (and people are tired after seven days of protests) so things could get really volatile fast. There's talk of protests on Saturday in Syria and reports of fighting with youths and police in Sudan.

Anyone who thinks this is going away soon because equities caught a bid (more like half a bid) could surely be mistaken. Tomorrow is the first of the month and a recent study showed the best trade was to simply go long equities the first day of the month. Literally just hold the first day of the month. So, we may see a little more bids come into the market. But following the April 2010 high, which I am sure many traders are watching the correlations, be careful about Wednesday. Don't forget the NFP report is on Friday. Heaven help anyone who believes any "strong" report out of ADP this month.

Ah - Risk Assets

Afternoon Update

Interesting to note the SPX retraced exactly 50% of Friday's move before turning back. Volume is pretty light compared to 50MA volume and Friday. Oil is up another 3% plus though which tells me people in the commodity space are not discounting a Suez canal shutdown or some other impact on oil prices.

The close will be interesting to watch. Rumors of PIIGS debt haircuts and Ireland revising down its GDP from 2.4% to 1% (ouch) should at some point in some normal world put pressure on the euro. Like I say, should...

Afternoon Update

Morning Update

I'm not adding to any positions until I see how the next two days plays out assuming they are similar to what we saw last April. Markets are still conditioned to buy the dip and this move up will further exhaust any long money left.

I'm glad I mentally prepared myself for this move up in thinking through what the price action may be today. Still crazy early and data in a few minutes could move the needle either direction.

I still believe shorts will be more emboldened here with a stop set at the prior highs on Friday.

Morning Update

Sunday, January 30, 2011

Comparison To April 2010 High

- In both run ups to the high, the middle bollinger band was not tested until just before the top was in.

- Both runs up did not touch the lower bollinger band at all during the move up.

- Both tops showed massive divergence on the MACD

- The move that pierced the middle bollinger band in both run ups was a massive red candle down. The candle on Friday was more powerful than the similar candle in April for it set a new high, failed to hold that high and closed on the low. Both candles also found support at the prior low where the middle bollinger was first tested.

- This is the key in understanding where we go from here. After the big red candle back in April, the next two days did move up, yet failed to make new highs before finally rolling over. Looking at the Asian markets right now and the ES futures, we may be in a similar attempted move up.

Personally, I think enough damage has been done from a technical standpoint, combined with questionable macro news (UK starting a new recession for example, US missing GDP on Friday, etc). I think many are not fully understanding what is happening in Egypt. To me it's not an Egypt story. No, I think it's a global revolution story. People have been oppressed for years and have finally had enough. Bears may be emboldened again should the market attempt to move up. It sets up a great trade with your stops at the prior highs should the market experience a move up the next few days.

The majority are expecting the market to move down on Monday, I would imagine and we know how that never works out. Even with the Fed and POMO and a market that always seems to catch a bid, the risk reward here favors the short trade to purely cash trade in my opinion. I remain short and hedged via credit call spreads but until a clear direction is shown, I won't be adding to my current position.

Comparison To April 2010 High

Monday January 31

Anyone who claims they understand these markets right now is lying to you. No one has any clue what is going on with risk assets. Sure they are rising but based on nothing other than the concept of the Bernanke put. Leverage is at Lehman levels, short interest is at a year low and the effects of POMO arguably are not as strong as back in the August pre-annoucment.

It's important to realize that all of us bears, bulls, whatever you want to call people have been conditioned to buy the dip. All dips have rallied the past 2 years pretty much. So to simply say this is the dip that does not bounce would be naive. There is a chance, a very good chance this dip does not bounce but we can't assume that with 100% certainty.

A majority of people "in the market" don't do their homework. They read the headlines. They don't question the headlines, let alone read the story. They take at face value what the media tells them or what some analyst tells them. Right now the group trade is very long in the tooth and highly participated. So with that said, many will be ready to deploy any cash that is left to go long. The same goes for bears who are very tired and timid at this point. Any signs of strength could easily build into even more strength. I saw a quote on Friday from a "trader" and I use that term loosely. Their quote "Egypt is a small country, the market is overreacting."

The easy trade has been buy anything, literally anything, ignore entry price because it will rise in value. Bill Fleckenstein says it best when he says "nonsense becomes knowledge." Anyone long anything feels pretty dam smart and the longer this rally has gone on the more their self confidence has been reinforced. Should this be the start of a larger correction, expect many "smart longs" to fight the tape as the bear did for a while. Expect them to buy any dip they can with any money they have left. It's worked for two years so why should it not work now they will ask themselves.

To think this is simply about one country in the Middle East is very naive. Many governments are borderline ready to experience their own Egypt and many more are going to do whatever they can to prevent any increase in discontent within their country. China is dealing with severe inflation right now and a labor force demanding more income, thus the 10% rise in minimum wage lately.

So there is a very real possibility markets show some strength the next day or two. You have to ask yourself though is that real? Personally I think any short term strength is simply a bounce. POMO is long in the tooth and its strength wearing thin. From a technical standpoint, lots of damage was done in very heavy volume across pretty much all sectors. Commodities have been selling off the past two weeks. The USD has shown some firming, especially with Friday's news. The VIX put in a 24% move to the upside (looks like some people on Friday decided they needed more than the Bernanke put).

The fact that Egypt is gaining in momentum versus quieting down should be worrisome across the world from an economic to policy standpoint.

I'm positioned short via hedged option trades. I won't be adding to the trade though until confirmation that my assumption of any bounces are indeed just that. I'm trying to prepare myself mentally though for various options come Monday and into the week. Pretty much everyone who manages money, whether it be their own or a fund is confused right now in terms of market direction.

Monday January 31

Saturday, January 29, 2011

COT Report Week Ending 1/25

SPX versus Copper Commercial Net

COT Report Week Ending 1/25

Q4 GDP Advance

Everyone was all giddy about the GDP number yesterday even though it was forecasted to be 3.5% and came in "light" at 3.2%. It's a safe bet to assume the future revisions to Q4 GDP will be revised down considering the government is in the game right now of instilling confidence and almost all data is revised down in subsequent reports.

The big takeaways was the final demand piece of the report. GDP can be analyzed in many ways, the 50,000 foot view is GDP = Final Demand + Change to Inventory.

Final demand came in at 7.1% which was a very strong number up from 0.9% in Q3.

Let's take a look at GDP under another definitions though.

GDP = Consumer + Investment + Government + Exports - Imports

Imports "grew" in Q4 at 2.4% thus adding to GDP versus being a drag in prior quarters (2.53, 4.58, 1.61). So net trade imbalance was a positive 3.4% to GDP versus drags on prior GDP (1.71, 4.5, .3). So how does our personal consumption increase while our imports decrease?

Government was a net drag of .1% versus adding to GDP of .8% in the prior two quarters. As government "austerity" or shall we say reality of lower tax revenue and higher deficits should cause continued drag to GDP in 2011.

Consumer grew at the expense of a lower savings rate and double the growth of real disposable income. Either the consumer is ready to spend far beyond their means again or expect this component to come down significantly in future reports. The other component helping the consumer is the slowdown in foreclosure. Those homeowners have not been paying mortgages for over fourteen months and as foreclosures are delayed, there is more "stimulus" to the economy. At some point though, foreclosures will start back up again and that stimulus will stop.

The economy still remains very fragile. Expect this report to be revised down in future revisions. With the government limited in their ability to stimulate the economy and in reality becoming more of a drag, any future shocks will have a far more significant impact on growth and this fragile economy's ability to absorb such shocks.

Q4 GDP Advance

Friday, January 28, 2011

Davos - The Money Quotes

On housing prices

"Overall, (housing) prices kind of bump around and it will take a few more years to get through this,"

Bump around? Thought bumping would be movement in both directions? Appears he's still waiting for the bump up.

On employment (or should I say unemployment)

On the issue of unemployment in the US, he said the current elevated figures are caused by those who have been out of a job for a long time and not by newcomers, which is a good sign for the quality of credit portfolios.

So apparently unemployment is a FIFO process. So those laid off recently will be the first to be employed versus those searching for jobs in excess of six months? Next time someone submits their resume (what is it five applicants for every one job available) they should just put a date stamp at the top so the employer won't have to bother reviewing the resume, just hire those most recently laid off?

On credit quality

The credit quality of the portfolio has improved and, overall, "the credit quality issue is behind the company and behind the US," Moynihan said.

The credit quality "issue" is behind us? So you are reducing provisions for loan losses and loan loss reserves in the face of falling asset prices, the highest duration of unemployment above 9% since ever and a shadow inventory that is not only growing but in a legal process that shows no sign of letting up in the near future.

Do these comments sound like someone that should be running one of the largest banks in the US? Look at the confidence this man exudes.

Davos - The Money Quotes

Thursday, January 27, 2011

Bank Revenue VS Efficiency Ratio

I won't add a lot of color as the charts speak for themselves. For the past two fiscal years, JPM and WFC have experienced flat revenue growth while BAC has experienced revenue contraction. Banks can be complicated animals to understand but if you break it down to very basic, big picture analysis they are actually easier to view. There are some FASB accounting of the top line but no where near the balance sheet gimmicks of mark to myth.

Bank Revenue VS Efficiency Ratio

US Debt - Is It Too Late Already?

US Debt - Is It Too Late Already?

The USD - Which Way Does It Go

It will be very curious to see how things in Egypt play out as they appear to have a pro democracy leader heading back to Egypt today to help lead the movement. It is certainly a very tense time in the world and like the USD or not, it does represent short term safety and could very easily catch a bid as the risk trade is unwound. Something to keep an eye on at least.

Markets appear to be more volatile the past few days in terms of intraday swings versus the December non stop march of the bulls.

The USD - Which Way Does It Go

Wednesday, January 26, 2011

AAII Sentiment Survey - Week Ending 1/25

AAII Sentiment Survey - Week Ending 1/25

BAC - The Consumer Side Of The Business

I examined BAC earnings by the seven business groups as defined in their earnings supplement to get a sense what is driving and what is impeding growth. What struck me as rather odd was the mix with the consumer side of the business.

I define consumer by adding the (1) Deposit Business, (2) Home Loans and Insurance and (3) Global Card Services. Below is a chart of each business unit as a percentage of total revenue net of interest expense.

Deposits - The fee side of the business, saving / checking accounts, money market funds, CDs, student loans. This business has started contributing more to the business but for the most part has remained flat.

Global Card Services - after taking a dip it has turned back up and contributed almost a third of total net revenue. I know this part of the business has been showing improved credit quality but I don't necessarily think that trend continues. For many, credit cards and HELOCs remain a key source of funding. In a recent post I discussed how only 35% of Americans have 3 months of emergency funds available. For now this business group has experienced continual drops in provisions for loan losses (14% drop Q4 2010 over Q4 2009). I suspect that reverses trend though in the coming year.

Home Loans - I was really surprised at this one. It has literally fallen off a cliff. Q4 2010 had a 600 million non interest loss making this quarter look even worse but clearly the trend is flat to slightly down. This clearly shows how weak the US housing market is with BAC being the leader in home mortgage. I came across a report from iEmergent (chart below) which forecasts flat to declining home loan origination in 2011 versus 2010 with refinance activity falling significantly.

iEmergent expects mortgage loan purchase volume plus refinancings of between $903.8 billion and $990.7 billion this year. "Expect total volume to move toward the lower end of the range if mortgage rates rise and the refinance spigot shuts off during the first half of the year," said Dennis Hedlund, president of the Iowa-based firm.

BAC - The Consumer Side Of The Business

CBO Forecasts

CBO Forecasts

30 Year Treasury - Big Move Is Coming

30 Year Treasury - Big Move Is Coming

Tuesday, January 25, 2011

1/25 Markets

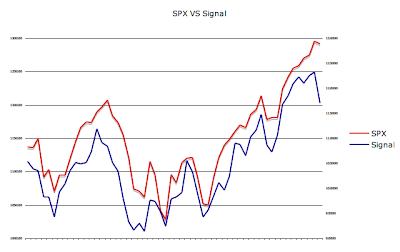

Oil and Copper both have served as excellent guide to the future of equity prices and since the highs of copper on 1/3 the following divergence has occurred.

Copper - down 5.7%

Oil - down 6.8%

SPX - up 1.6%

IWM - down 3.5% from its 1/19 high

Seeing that move down in the USD towards the end of the day was a little ominous and may have triggered some equity buying perhaps? These markets are very confusing right now. What's happening across the globe in terms of uprisings against the government are equally scary. All it takes is one shock event and treasuries and the USD will catch a very solid "flight to safety" bid at the expense of equities.

We are at very high levels of optimism with risk assets and very high levels of leverage. A very toxic combination when the day arrives.

1/25 Markets

Mortgage Lending

We need banks, don't get me wrong. Without some ability to form credit most of us would be living in an apartment and not a home. So in the good times, banks are very profitable but just like with trading risk management is key.

I was doing a back of the envelope calculation to see at what points do defaults wipe out earnings from the vast majority of conforming loans.

I assumed a $200,000 mortgage, 5% 30 year fixed rate, a recovery of 40% on defaulted credits (would include the expense of foreclosing as well).

It only takes about a 9% default rate to wipe out the net interest revenue of the other 91% that conform.

Mortgage Lending

Monday, January 24, 2011

Loan Loss Reserves - A Comparison

For the most part C, BAC, JPM are reserving roughly the same amount (4-5% for BAC and JPM and 6% for C). Wells on the other hand leads us to believe they have far higher quality credits on their balance sheet with reserves in the 3% range. Not sure why that is. For WFC to reserve relative to BAC and JPM they would need to add about 15 billion or in other words, they are more prone to balance sheet risk assuming their credit quality is similar to their competitors.

Based on some recent litigation regarding put back requests, it is arguable that BAC and JPM are under reserved as well and should be reserved more in the range of C. Taking it one step further, does anyone honestly believe any of these reserves are based on the reality of a double dip in housing prices that has been ongoing for about four months now? What about second tier credit quality? What about the risk of mortgage cram downs? What about the risk of increased strategic defaults in the face of the longest duration of unemployment ever?

Balance sheet risk could very well be the theme of 2011 bank earnings.

Loan Loss Reserves - A Comparison

Not Everyone Dislikes Bernanke's Monetary Policy

"The Bank of Japan on Tuesday revised up its consumer price forecast for the fiscal year beginning in April, a move that reflects the impact of recent rises in commodity prices."

Oh wait, what's this next line?

"On the underlying economy it kept its assessment that while the economy was showing signs of a moderate recovery, the improvement seems to be pausing."

So inflation due to money supply growth and NOT velocity growth can actually cause an economy to go back into the tank? Scratch Japan from the list.

Not Everyone Dislikes Bernanke's Monetary Policy

Cramer - Does He Do These Shows While Drunk?

Cramer - Does He Do These Shows While Drunk?

Definition Of A Bad Bank

So we see falling revenues and a rising efficiency ratio (which really should be called an inefficiency ratio based on the way it is calculated). Either this economy better respond fast or they better get expenses under control. Both of which seem rather lofty goals in the current environment.

Definition Of A Bad Bank

Waiting For Trades To Set Up

I pulled up a 5 day 30 minute chart and waited until GE closed below support which it did. I sold some Feb 19/20 call spreads. Ideally I'll buy back the call spreads when the gap is filled.

Waiting For Trades To Set Up

Interesting Morning

DXY is really due for a bounce here.

Interesting Morning

Sunday, January 23, 2011

BAC Earnings Versus Balance Sheet Risk

I'm sharing this data as part of a group think exercise and asking for any feedback that can help all of us. Before I show the two simple charts, let me shed some light on the terminology for those who actually did something more social this weekend versus study bank financials.

Total Net Revenue is broken into two groups:

1 - Net Interest Income (interest income minus interest expense)

2 - Non Interest Income

Combing the two gives you total revenue. That revenue then needs to cover three main expenses:

1 - Non Interest Expense (staff, legal, pretty much all operating expenses)

2 - Provisions for credit losses

3 - Income to shareholders.

The first chart I show is Total Net Revenue minus Non Interest Expense (in other words income left to cover provisions for credit losses and income to shareholders) VS Provisions for Credit Losses. This one is simple and not good looking. Since Q1 2009 income available to service provisions has dropped dramatically and shown no recovery. At the same time provisions have also dropped. Sure there is some tweaking of provisions to prevent / minimize losses but the question that needs to be answered is will the red line (provisions for credit losses) be forced to trend up again. To answer this question, I then looked at total loans and leases on the balance sheet and allowance for credit losses (the amount reserved for future credit losses).

BAC Earnings Versus Balance Sheet Risk

Saturday, January 22, 2011

Insanity

First and I can't even begin to understand this one nor is it worth the brain power to get into the minds of the newest in ponzi schemes. Somehow, again don't ask me how the EFSF (European Financial Stability Facility) is looking to buy back debt which now trades below par. Who are they buying it back from? Don't they own it? Didn't they buy debt from Ireland and Greece, etc?

This one is amusing as well. So there has been no shortage of talk about the Fed and the capital losses they have realized in just a few months as treasuries yields have risen. To remain "solvent" the Fed will adjust their liabilities to offset the drop in asset prices. So the more they lose the less they owe. What? I'm not making this stuff up.

Do these events sound like desperation to you or did I just fall on my head and lost any sense of rational thinking I had?

Insanity

The Health Of The Consumer

The number of people in some form of default on their mortgage continues to rise. The average time from the first missed payment to REO is in excess of fourteen months and higher depending on who is reporting. Imagine not making a mortgage payment for fourteen months. What do you do with that money? You don't save it all. You spend it on things you are "entitled" to because the sad truth right now is our society for the most part feels entitled.

Consumers guard their credit card and HELOCs because it is their only form of credit and yet the banks spin this as a positive about their assets, their credit quality. Again, I say nonsense. I came across two charts that really support this view.

For the first time in over sixty years, Americans had a net withdrawal of financial assets, whether it be savings, 401K plans, etc. Americans are suffering hard right now. One in five are employed part time. Part time work is necessary and there is nothing wrong with that form of employment but the reality is you cannot grow an economy with limited wages and reduced benefits.

The Health Of The Consumer

Friday, January 21, 2011

BAC Q4 2010 Earnings

Net interest income was the only positive for Fiscal 2010 for BAC as it was up 9.4%. The bad news? A 7.9% decrease in total net revenue and a 24.5% rise in non interest expense for Fiscal 2010 versus 2009. To be fair, there was a 12,400 goodwill impairment taken during Q3 and Q4 2010 but to be even fairer one must realize in Fiscal 2010 BAC halved its provision for loan losses over 2009 from 48,570 to 28,435.

The ability for banks to tweak earnings by adjusting provisions for loan losses is a disservice to investors. From Q4 2009 to Q4 2010 allowance for credit losses increased by 4,685 which means in all of Fiscal 2010 total balance sheet write down due to loan losses was 33,120. The total in 2009 was 48,570. 2010 saw record foreclosures. If someone can explain to me why 2010 provisions were so low other than to simply offset goodwill impairment charges and tweak earnings, please let me know. I honestly would like to understand. Seems to me BAC is setting themselves up for some nasty earnings in 2011 which will make 2010 look good. Right now they look horrid. My take at least.

BAC Q4 2010 Earnings

BAC Efficiency Ratio Q4 2010 VS Q4 2009 (Updated)

Ouch! This past quarter the efficiency ratio was 93.2% (non interest expense / revenue net of interest expense) versus 65.3% in Q4 2009. That is a pretty massive increase in expenses while total revenue net of interest expense dropped from $119,643 in Q4 2009 to $110,220 in Q4 2010 (an 8% drop in revenues).

So you have falling revenues and higher expenses. In Fiscal 2010 BAC spent 83,108 in non interest expense (70,708 backing out 12,400 in goodwill impairment, anyone say they paid too much for Countrywide) versus 66,713 in Fiscal 2009. The result was an efficiency ratio of 75.4% (64.2% net of goodwill) for Fiscal 2010 versus 64.2% for Fiscal 2009.

This is not a good trend and whatever CNBC analysts say, this bank is trouble.

BAC Efficiency Ratio Q4 2010 VS Q4 2009 (Updated)

BAC Cash Flow Statement - The Easy Version

December 7, 2010

BAC Cash Flow Statement - The Easy Version

COT Report Week Ending 1/18

COT Report Week Ending 1/18

Investor Intelligence Sentiment Survey

Investor Intelligence Sentiment Survey

It's All About The FX Markets

It's All About The FX Markets

Thursday, January 20, 2011

Dwindling Loan Loss Reserves

Dwindling Loan Loss Reserves